Post by The Big Daddy C-Master on Jul 27, 2015 9:54:29 GMT -5

www.randpaul.com/

Iran and the five permanent members of the UN Security Council plus Germany (commonly called P5+1) achieved a long-term comprehensive nuclear deal with Iran that will verifiably prevent Iran from acquiring a nuclear weapon and ensure that Iran's nuclear program will be exclusively peaceful going forward, according to a White House press release. One of the biggest factors that helped to make this deal possible was the promise to end economic sanctions imposed on the country after the 1979 revolution. It was this promise that continually brought Iran to the bargaining table.

Forbes magazine reports, after several years of negotiations, Iran and the P5+1 countries have finally agreed to a timeline for sanctions relief. The 100-plus page Joint Comprehensive Plan of Action (JCPOA) sets forth an agenda to wind down the decades long sanctions program on Iran. We examine a list of five groups who stand to benefit the most from an end to Iranian sanctions.

Iranian Oil Industry

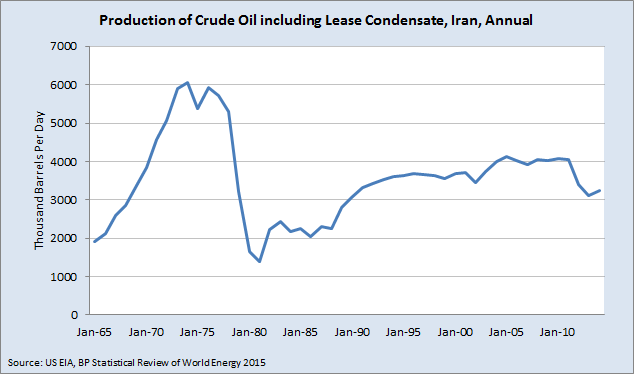

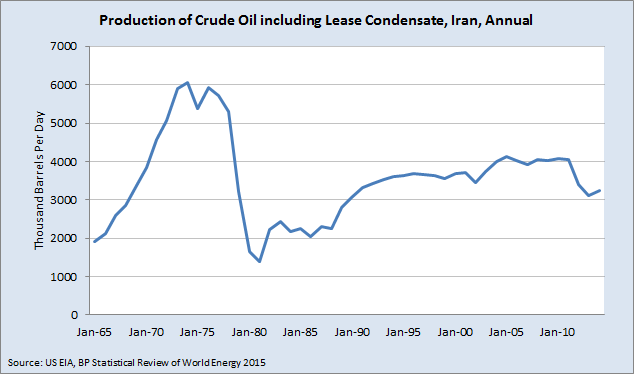

The Iranian oil industry itself will likely be the biggest benefactor to an ending of western sanctions. Years of under-investment and a lack of new equipment have taken their toll on Iranian oil production (see chart). Before the 1979 revolution, Iranian oil production peaked at 6 million barrels per day, but has struggled to achieve a similar level ever since.

Richard Nephew, a former official specializing in the sanctions regime with the U.S. Department of State, estimates “300-500 kb/d of new barrels of oil on the market within 6-12 months after a deal begins to be implemented.” Wood Mackenzie, an oil consultancy, expects only 600 kb/d of new oil output by the end of 2017, according to Forbes. Ending the stagnation in output is the most important factor for Iran’s oil industry. This will be much easier once sanctions are removed.

Western Oil Majors

Another big winner will be western oil companies with the technology and know-how to get Iran’s oil industry back on its feet. In December 2013 Iranian Oil Minister Bijan Zanganeh named the seven oil companies Iran wants back in its vast oil and gas fields when international sanctions are lifted, according to Reuters. The list which he named in order includes: Total SA of France (TOT), Royal Dutch Shell (RDS.A), Italy's ENI, Norway's Statoil, Britain's BP Plc (BP) and U.S. companies Exxon Mobil Corp. (XOM) and ConocoPhillips Co. (COP).

More recently, Bloomberg reported in June 2015 that Royal Dutch Shell Plc (RDS.B) executives visited Tehran to discuss possible partnerships, the latest sign that the largest oil companies are serious about returning to Iran, once a deal on the country’s nuclear program is done.

Look for western companies to be tripping over themselves to get back into Iran without the fear of US reprisals in the next year or two. Iran is one of the last great oil frontiers with decent onshore (low cost) oil acreage.

Iranian Banks

Another winner will be the 30 Iranian banks that could regain access to the SWIFT international money transfer network. In March 2012, following an EU Council decision, SWIFT announced it had been instructed to discontinue its communications services to Iranian financial institutions that are subject to European sanctions. This has been a big blow to Iranian banks’ ability to process payments and conduct normal business. Russia today reported in July 2015 that “Iran's Day Bank has announced joining the SWIFT transaction system,” in a sign that things may already be changing. (For more, see: How the SWIFT System Works.)

European Gas Consumers

Europe also hopes to be able to count on Iran to diversify gas supplies away from Russia. Total SA says in a press release that, “In a first stage, Iran could serve as a transit country for gas coming from Turkmenistan, a country that is rich in gas (the world's fourth largest reserves) but poor in transportation infrastructure for now. In a second stage, gas consumed in Europe could come from Iran itself.” But Fitch Ratings warns that major Iranian gas exports will take at least five years, noting that it will take time for the country to ramp up production and build the pipelines necessary to become a large gas exporter.

Frontier Investors

Investors eager to get access to Iran’s investment opportunities could also be big winners when sanctions end. Reuters reports that with almost 80 million people and annual output of some $400 billion, Iran will be the biggest economy to re-join the global trading and financial system since Russia emerged from the ruins of the Soviet Union over two decades ago.

The Bottom Line

There are multiple parties that will benefit from the lifting of Iranian sanctions and the country's return to the international community. Energy investment will be an important theme in the years ahead, especially when oil prices start rising. The country’s young demographic profile, with 60% of the population under 30 - according to iranprimer.usip.org, offers unique markets and investment opportunities that are presently lacking in developed markets.

Read more: www.investopedia.com/articles/investing/072415/who-benefits-lifting-iran-sanctions.asp#ixzz3h6UswYZz

Follow us: @investopedia on Twitter

Iran and the five permanent members of the UN Security Council plus Germany (commonly called P5+1) achieved a long-term comprehensive nuclear deal with Iran that will verifiably prevent Iran from acquiring a nuclear weapon and ensure that Iran's nuclear program will be exclusively peaceful going forward, according to a White House press release. One of the biggest factors that helped to make this deal possible was the promise to end economic sanctions imposed on the country after the 1979 revolution. It was this promise that continually brought Iran to the bargaining table.

Forbes magazine reports, after several years of negotiations, Iran and the P5+1 countries have finally agreed to a timeline for sanctions relief. The 100-plus page Joint Comprehensive Plan of Action (JCPOA) sets forth an agenda to wind down the decades long sanctions program on Iran. We examine a list of five groups who stand to benefit the most from an end to Iranian sanctions.

Iranian Oil Industry

The Iranian oil industry itself will likely be the biggest benefactor to an ending of western sanctions. Years of under-investment and a lack of new equipment have taken their toll on Iranian oil production (see chart). Before the 1979 revolution, Iranian oil production peaked at 6 million barrels per day, but has struggled to achieve a similar level ever since.

Richard Nephew, a former official specializing in the sanctions regime with the U.S. Department of State, estimates “300-500 kb/d of new barrels of oil on the market within 6-12 months after a deal begins to be implemented.” Wood Mackenzie, an oil consultancy, expects only 600 kb/d of new oil output by the end of 2017, according to Forbes. Ending the stagnation in output is the most important factor for Iran’s oil industry. This will be much easier once sanctions are removed.

Western Oil Majors

Another big winner will be western oil companies with the technology and know-how to get Iran’s oil industry back on its feet. In December 2013 Iranian Oil Minister Bijan Zanganeh named the seven oil companies Iran wants back in its vast oil and gas fields when international sanctions are lifted, according to Reuters. The list which he named in order includes: Total SA of France (TOT), Royal Dutch Shell (RDS.A), Italy's ENI, Norway's Statoil, Britain's BP Plc (BP) and U.S. companies Exxon Mobil Corp. (XOM) and ConocoPhillips Co. (COP).

More recently, Bloomberg reported in June 2015 that Royal Dutch Shell Plc (RDS.B) executives visited Tehran to discuss possible partnerships, the latest sign that the largest oil companies are serious about returning to Iran, once a deal on the country’s nuclear program is done.

Look for western companies to be tripping over themselves to get back into Iran without the fear of US reprisals in the next year or two. Iran is one of the last great oil frontiers with decent onshore (low cost) oil acreage.

Iranian Banks

Another winner will be the 30 Iranian banks that could regain access to the SWIFT international money transfer network. In March 2012, following an EU Council decision, SWIFT announced it had been instructed to discontinue its communications services to Iranian financial institutions that are subject to European sanctions. This has been a big blow to Iranian banks’ ability to process payments and conduct normal business. Russia today reported in July 2015 that “Iran's Day Bank has announced joining the SWIFT transaction system,” in a sign that things may already be changing. (For more, see: How the SWIFT System Works.)

European Gas Consumers

Europe also hopes to be able to count on Iran to diversify gas supplies away from Russia. Total SA says in a press release that, “In a first stage, Iran could serve as a transit country for gas coming from Turkmenistan, a country that is rich in gas (the world's fourth largest reserves) but poor in transportation infrastructure for now. In a second stage, gas consumed in Europe could come from Iran itself.” But Fitch Ratings warns that major Iranian gas exports will take at least five years, noting that it will take time for the country to ramp up production and build the pipelines necessary to become a large gas exporter.

Frontier Investors

Investors eager to get access to Iran’s investment opportunities could also be big winners when sanctions end. Reuters reports that with almost 80 million people and annual output of some $400 billion, Iran will be the biggest economy to re-join the global trading and financial system since Russia emerged from the ruins of the Soviet Union over two decades ago.

The Bottom Line

There are multiple parties that will benefit from the lifting of Iranian sanctions and the country's return to the international community. Energy investment will be an important theme in the years ahead, especially when oil prices start rising. The country’s young demographic profile, with 60% of the population under 30 - according to iranprimer.usip.org, offers unique markets and investment opportunities that are presently lacking in developed markets.

Read more: www.investopedia.com/articles/investing/072415/who-benefits-lifting-iran-sanctions.asp#ixzz3h6UswYZz

Follow us: @investopedia on Twitter